We've tried to answer some of your most frequently asked questions about our most popular online and mobile tools: our Mobile App and Online Banking. If you don't find the answer you're looking for, please don’t hesitate to contact us.

How do I reset my username or password?

If you have already logged into our new upgraded system, you can reset your password and retrieve your username by using the Forgot Username or Forgot Password links on our Online Banking or Mobile Banking platforms.

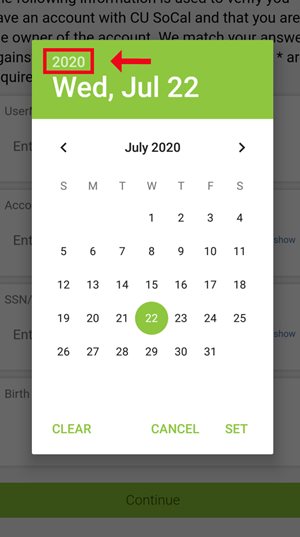

On my Android device, how do I enter my date of birth when I am resetting my password in the Mobile App?

To enter your date of birth, first click the year at the top. This will allow you to quickly scroll to your birth year. From there, select your birth month and date in the calendar function.

Are there specific browser requirements for Online Banking? What browsers are supported?

Online Banking supports the last two versions of the browsers listed below:

Android: v6.0 and higher

Firefox: Latest two versions

Google Chrome: Latest two versions

Internet Explorer: v11*

IOS: Last two major versions

Microsoft Edge: Latest two versions

Safari: Last two major versions

*Limited Support: Some functionality may not work as expected. End users with IE 11 as their browser will still be able to access essential functionality of Online Banking.

To check your browser compatibility, click the link below:

Browser Support

Why does Online Banking log me off automatically?

To protect your privacy, we default Online Banking to log you off automatically after 15 minutes of inactivity.

How do I set notifications for my accounts?

To be alerted about your account balances, transactions, automatic deposits, cleared checks, loan payment due and much more, go to “Settings” and then “Notifications.” In the “General Alerts” section of “Notifications” you can turn on alerts by email, text, push notifications (or all three methods together), and then customize your method of notification for each separate alert that you set up.

Does the iOS app work on the iPad?

Yes, you can use the iOS version on an iPad. However, it isn't designed as an iPad app so you might encounter some "quirks." Most of these will be related to visual display and not operational functionality. We recommend using your mobile phone for the best mobile experience.

Can I use Quicken with my CU SoCal accounts?

Yes, simply search for Credit Union of Southern California from Quicken to link to your accounts.

I am having issues connecting my account to Quicken

Confirm you are using a recent version of Quicken. Quicken will only support the three most recent versions of its product. While your accounts and transactions may still be stored on an older version, features such as One Step Update will fail. For a list of supported Quicken products please visit https://www.quicken.com/support/quicken-discontinuation-policy.

Remove closed accounts from One Step Update. Closed accounts within Direct Connect and One Step Update may impact how Quicken downloads transactions for other active accounts. Check your Account List and be sure to review any hidden accounts to ensure that all closed accounts have been removed from One Step Update.

Also please

click here visit our Quicken FAQ.